This service is designed to help you manage and grow your wealth to achieve your most important financial goals, providing you with a simple and actionable plan tailored to your requirements.

We are phygital.

Our experience is truly unique. We are digital at the core with personalised advice delivered to you via a human-led coaching experience. Wealth Maximiser’s proprietary advice model codifies nine wealth building blocks.

We start by addressing the building blocks most relevant to your current situation.

As we progress through your plan, we’ll expand into other building blocks to maxmise wealth and management.

Estate planning allows individuals to have control over the distribution of their assets and minimise taxation or disputes, after they have passed away. Creating wills, establishing trusts, and considering future wealth transfer are vital for preserving wealth and ensuring a smooth transition for future generations.

Planning for retirement helps secure financial independence and a comfortable lifestyle in later years. Setting retirement goals, estimating expenses, and implementing a suitable retirement savings strategy are essential for achieving a worry-free retirement.

Investing in shares, ETFs, bonds, and other financial instruments can provide opportunities for capital growth and income generation, especially in the long term. Diversifying investments across various asset classes helps mitigate risk and maximise returns over the medium to long term.

The Australian retirement savings system is crucial for long-term financial security. Contributing regularly to a super fund and maximising employer contributions can help you build a substantial retirement nest egg and enjoy a comfortable retirement. Super can also be a tax effective structure to accumulate wealth.

Real estate investments offer potential income, capital appreciation, and diversification. Investing in properties allows individuals to generate rental income, benefit from long-term property value appreciation, and build a tangible asset portfolio. The benefits of negative gearing may also be realised.

Income is the foundation of wealth creation. It provides the means to save, invest, and build wealth over time. Maximising and protecting income sources increases financial stability and the ability to pursue wealth-building opportunities.

This building block focuses on managing personal finances effectively. Saving a portion of income, creating budgets, and managing debt are vital for long-term financial security. They enable individuals to live within their means, avoid excessive debt, and build a foundation of savings.

Optimising financial structures and tax planning can significantly impact wealth accumulation. Proper structuring of assets and investments, along with strategic tax planning, provides a foundation that can minimise tax liabilities and maximise tax benefits, leading to enhanced wealth preservation and growth.

Insurance coverage is essential for protecting accumulated wealth and mitigating financial risks. Adequate life insurance and income protection insurance can safeguard against unforeseen events that could otherwise deplete wealth and disrupt financial stability.

Estate planning allows individuals to have control over the distribution of their assets and minimise taxation or disputes, after they have passed away. Creating wills, establishing trusts, and considering future wealth transfer are vital for preserving wealth and ensuring a smooth transition for future generations.

Planning for retirement helps secure financial independence and a comfortable lifestyle in later years. Setting retirement goals, estimating expenses, and implementing a suitable retirement savings strategy are essential for achieving a worry-free retirement.

Investing in shares, ETFs, bonds, and other financial instruments can provide opportunities for capital growth and income generation, especially in the long term. Diversifying investments across various asset classes helps mitigate risk and maximise returns over the medium to long term.

The Australian retirement savings system is crucial for long-term financial security. Contributing regularly to a super fund and maximising employer contributions can help you build a substantial retirement nest egg and enjoy a comfortable retirement. Super can also be a tax effective structure to accumulate wealth.

Real estate investments offer potential income, capital appreciation, and diversification. Investing in properties allows individuals to generate rental income, benefit from long-term property value appreciation, and build a tangible asset portfolio. The benefits of negative gearing may also be realised.

Income is the foundation of wealth creation. It provides the means to save, invest, and build wealth over time. Maximising and protecting income sources increases financial stability and the ability to pursue wealth-building opportunities.

This building block focuses on managing personal finances effectively. Saving a portion of income, creating budgets, and managing debt are vital for long-term financial security. They enable individuals to live within their means, avoid excessive debt, and build a foundation of savings.

Optimising financial structures and tax planning can significantly impact wealth accumulation. Proper structuring of assets and investments, along with strategic tax planning, provides a foundation that can minimise tax liabilities and maximise tax benefits, leading to enhanced wealth preservation and growth.

Insurance coverage is essential for protecting accumulated wealth and mitigating financial risks. Adequate life insurance and income protection insurance can safeguard against unforeseen events that could otherwise deplete wealth and disrupt financial stability.

Four step program

Meet an Adviser

Book a free 20-minute call with one of our Financial Advisers - a chance to ask questions, share what's going on and see if we are the right fit.

Get started

Choose your plan and complete your client intake form.

Receive advice

Meet with your Financial Adviser who will deliver your personalised financial plan.

Achieve your goals

Access your dashboard for group coaching, regular updates, and actionable 90-day checklists to keep you accountable and on track.

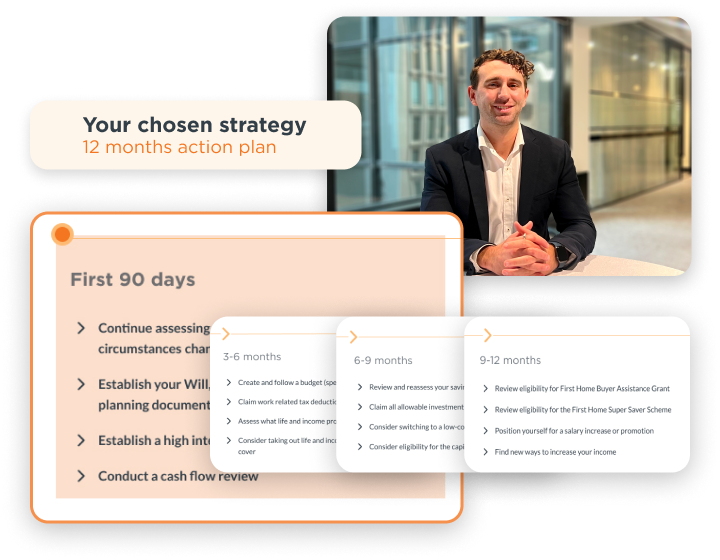

Your first session with a Wealth Coach will be a one-on-one Strategy Session – this will last up to an hour. In this session your Wealth Coach will help you determine which wealth strategy may be best for you and go through your action plan. The Wealth Coach Strategy Session is included in each of the Gold, Silver and Bronze packages.

If you are on a Gold plan, in addition to the Wealth Coach Strategy Session, you will be invited to three one-on-one Wealth Coach Check-in sessions per year. We will aim to arrange these approximately every three months. These sessions are intended to check your action plan is still working for you and for the Wealth Coach to answer any questions you may have.

If you are on a Silver plan, in addition to the Wealth Coach Strategy Session, you will be invited to one one-on-one Wealth Coach Check-in per year. We will aim to arrange this session approximately six months after your Wealth Coach Strategy Session. This session is intended to check your action plan is still working for you and for the Wealth Coach to answer any questions you may have.

Bronze plans do not include any Wealth Coach Check-in sessions. If you want to include a Wealth Coach Check-in session in your plan, you can ask to upgrade to the Gold and Silver package.

For all packages, if your circumstances change significantly at any point let us know so we can adapt your action plan accordingly.

Under the Bronze, Silver and Gold plans, as you approach the anniversary of when you signed up for Wealth Maximiser, you will be invited to update your details on the website. If your situation has changed significantly at that point, you can book another Strategy Session to see if a different strategy may be more suitable, otherwise you can book in for a Check-in.

You can also speak to a Wealth Coach at the monthly online group coaching sessions. You can learn more about the group coaching sessions below.

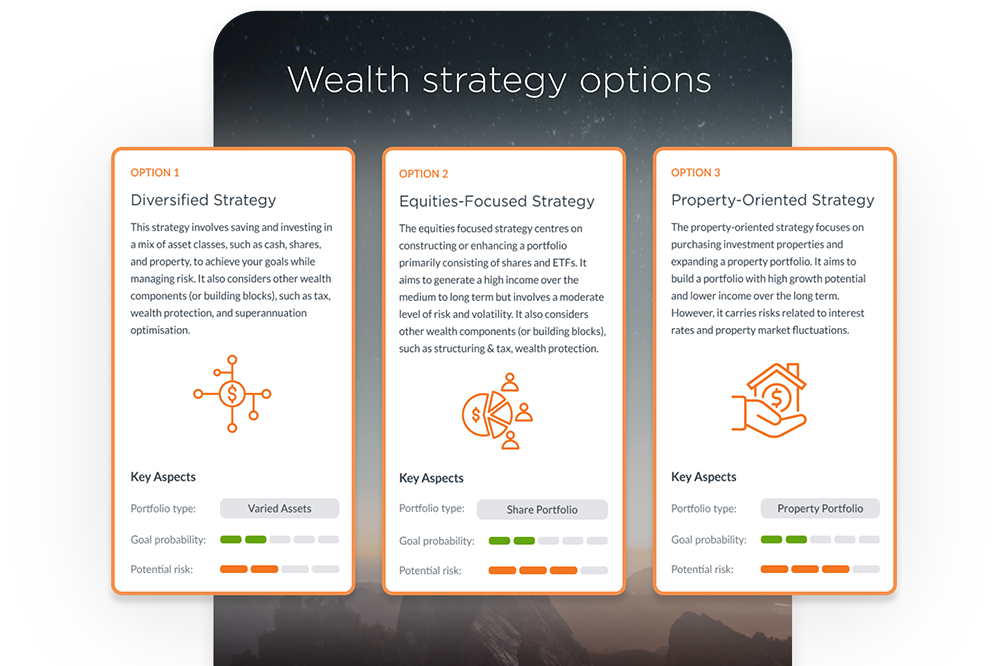

We review your goals, risk tolerance, financial, and lifestyle situation to determine which overarching wealth strategies and associated actions may be a good fit for you.

After you have completed all answers on the website and set up a Wealth Coach call, you will be emailed three wealth strategy options to review in discussion with your Wealth Coach. By way of example only, those strategies may include: a super and savings based strategy, an equities based strategy, an investment property based strategy.

Your strategy options will also include information on the indicative risk return profile of these strategies and how implementing those strategies may affect how likely you are to achieve your goals.

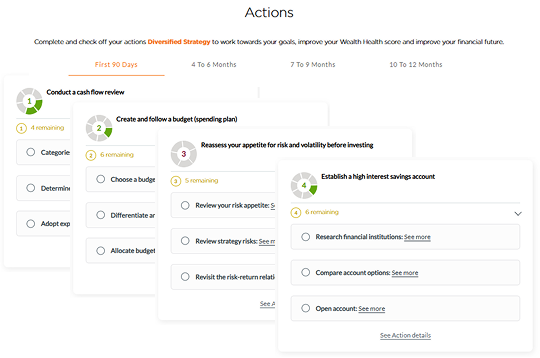

During your Wealth Coach Strategy Session, your Wealth Coach will help you determine which wealth strategy is best for you and then talk you through the tailored year long action plan based on that strategy. Your action plan will include 16 actions for you to complete over four 90-day periods (with four actions per period). Each action will include a description of the action, a summary of risks and considerations, how the action relates to your goals and the Wealth Building Blocks, and a checklist to work through to complete the action.

No, Wealth Maximiser does not include specific product recommendations. Instead, Wealth Maximiser offers product selection support for ETFs, Brokerage, Super, Wills and Estate Planning. Our Wealth Coaches provide guidance to help you make informed decisions that align with your goals. However, the final choice is yours. This is included within the Silver and Gold plans and is available at an additional cost for Bronze plans.

This service may not be suitable for those seeking comprehensive financial advice.

For more information, please contact [email protected].

If you experience significant changes to your financial circumstances, this may change which wealth strategy you may want to use, and accordingly, your financial projection or goal likelihood. In this scenario, Wealth Coaches need to re-review your advice, which may result in a new Statement of Advice and Strategy Session with them. This is only available to Gold customers. If you are a Bronze or Silver customer that experiences significant changes in circumstances during the year, you can upgrade to Gold by going on your profile and selecting ‘Upgrade my plan’ or pay a one-off fee of $299.

For more information on what is regarded as a significant change, please read our Terms and Conditions.

Yes, we take data security seriously. We use security measures to protect your financial information. Please see our privacy policy for more information.

The group coaching sessions will include 30 to 45 minutes of educational information on a hot topic, for example Investing in ETFs. They will also include 30 to 15 minutes for Q&A. In the Q&A you can ask questions that relate to your personal situation or strategy and the Wealth Coach will follow up with you separately if it requires a personalised answer.

Each monthly group coaching session will be hosted by one of our Wealth Coaches, who are qualified financial advisors.

Wealth Maximiser may not be suitable for the following customers:

– those looking for specific product recommendations

– those looking for advice on general insurance or credit management services

– those looking for sophisticated investment management advice, or for advice on options, derivatives or cryptocurrency

– those currently going through a separation

– those expecting a major medical expense or critical illness

As we are a new service we currently do not provide advice for individuals currently on a temporary visa in Australia.

No, we do not take commissions or fees from other providers. The only fee we take is from customers purchasing monthly/yearly plans.

Each monthly educational email will include information tailored to your action plan or chosen strategy, to help you take steps forward.

It will also include one or two of the following:

– Details on significant market changes (e.g. interest rate changes)

– Reminder on key actions to complete at this time of the year (e.g. start tax planning)

– Educational content on hot topics (e.g. psychology of money)

Yes, we provide customer support to assist you with any questions or technical issues you may encounter please email [email protected]

Book your no obligation

complimentary

25 minute Goal Setting session with a Wealth Coach

Book a free session