Hey Nick, Are you sure you want to leave?

Don’t give up, you’re almost there.

The next few questions will help us understand your relationship with money, in less than five minutes.

Let's go

Let's start simple.

Your age range

What does money represent to you?

How do you decide whether to make a big purchase?

How often do you think about money?

If your investments go down, how does this make you feel?

How would you describe your current financial situation?

What’s on the horizon?

Select at least 3 options

How much do you have in savings, investments and super?

This includes savings accounts, shares, or anything you’ve set aside.

How much do you earn?

We don’t need the specifics for now. These are annual salaries excluding super.

Are you saving as much as you would like today?

Of six-figure earners are still living paycheck to paycheck.

Of six-figure earners are still living paycheck to paycheck.

Of Australians are considered financially illiterate.

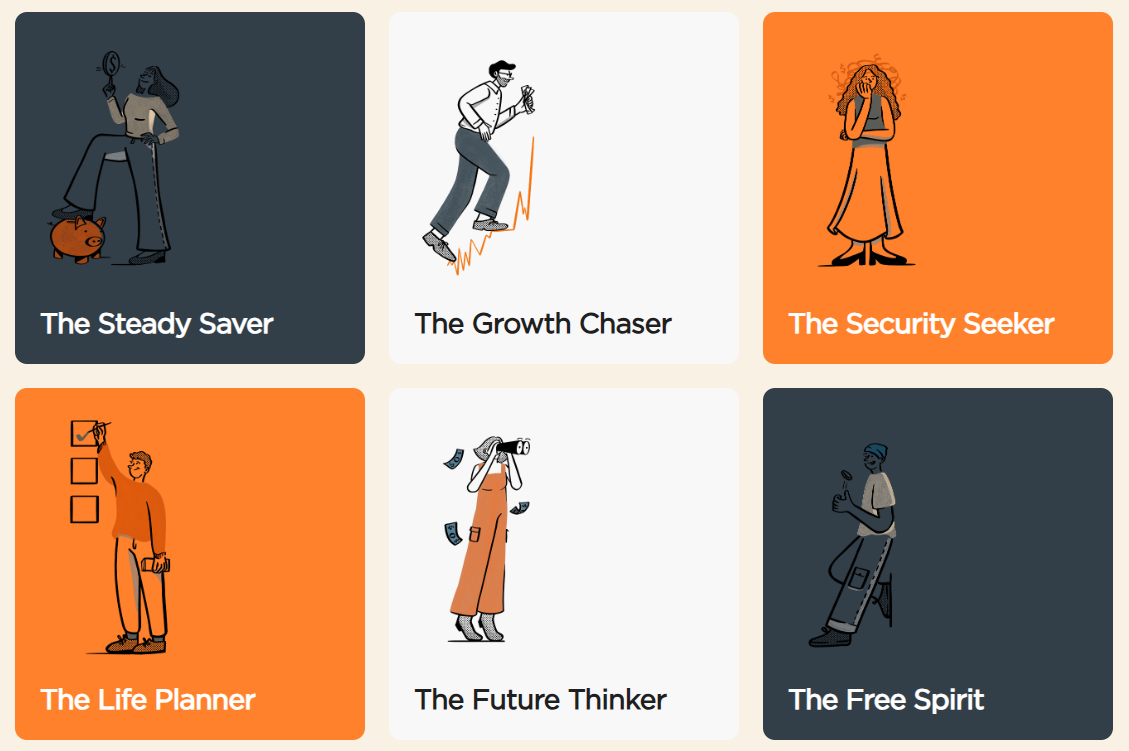

The Steady Saverxx

Disciplined and risk-averse, you prioritise financial stability by consistently saving money and making conservative financial choices.

Discover your habits below and how Wealth Maximiser can help you.

You save regularly, keep tabs on your budget, and do your research before making money moves. You prefer security over risk — and it shows.

You save regularly, keep tabs on your budget, and do your research before making money moves. You prefer security over risk — and it shows.

You save regularly, keep tabs on your budget, and do your research before making money moves. You prefer security over risk — and it shows.

You save regularly, keep tabs on your budget, and do your research before making money moves. You prefer security over risk — and it shows.

Something went wrong.

Please try again.

Our qualified Financial Advisers are focused on financial literacy and empowerment by understanding peoples habits, psychology, and attitudes towards money.

Answer our questionnaire to unpack your financial behaviours and understand your relationship with money.

Meet with your personal Wealth Coach, who will get to know you over a free 20-minute call.

Choose your membership and complete your fact find — your coach will then recommend three personalised financial strategies tailored to your life and goals.