Enough is enough. It's time to get financially fit.

Get your personalised financial action plan and 1-1 Wealth Coaching today

Peachii has partnered with the financial wellbeing experts at Wealth Maximiser to help you with all of the money things in your pre-rich era. Think of it like a personal trainer for your finances. Personalised financial strategies, action plans and wealth coaching to turn your financial goals into reality. All of your dreams and aspirations, none of the scams, shams or soul-selling to get you there.

Money help for your pre-rich era

Wealth Coach Experts

Guidance from expert Wealth Coaches at your fingertips. It’s personalised for you, 1-on-1 AND cheaper than a traditional financial adviser. Retire at 40 with an Alpaca farm. Give Dan Bilzerian’s yacht a run for its money. Whoever you want to be, we’ll work to make your aspirations a reality.

“Help” on all the bits

Budgeting, investing in property, shares and retirement planning. Peel back the layers and learn life-changing skills of these building blocks to wealth. Demystify where your money is going and set financial goals.

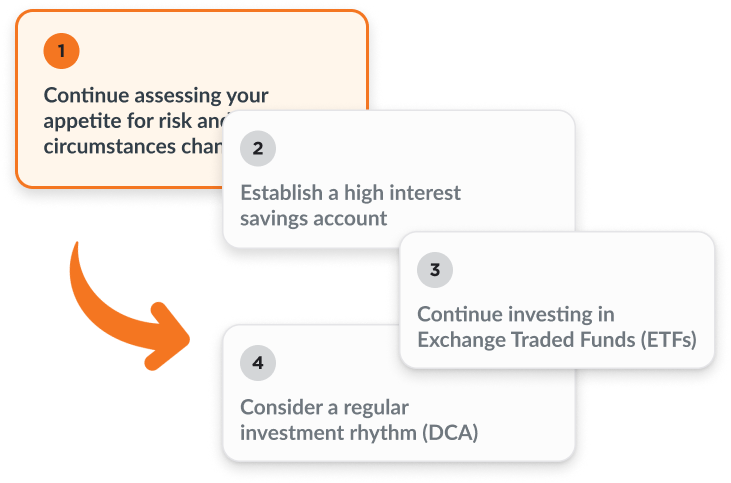

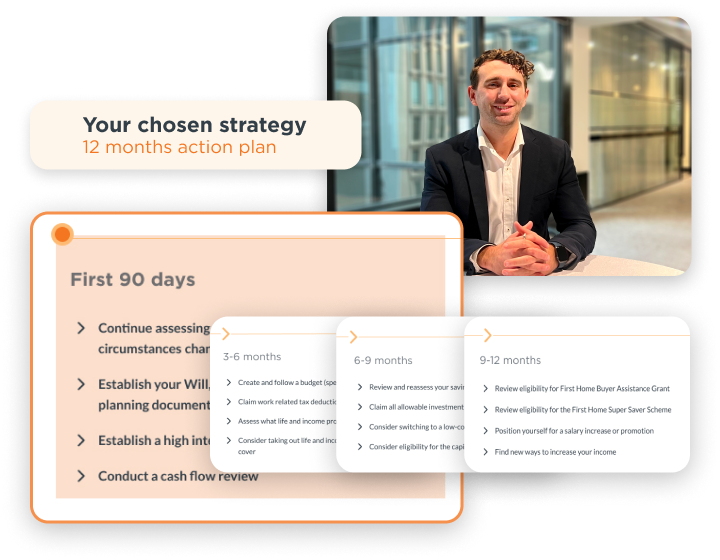

90-day roadmap

A clever year-long action plan, broken down into bite-sized, 90-day checklists. Easy to action and realistic plans to keep you on track and inspired to improve.

Stay accountable to smash your goals with regular 1:1 check-ins, group coaching and personalised updates.

Yes, there’s homework. Aside from the mental gold stars for completing it, you’ll enjoy watching those dreams become your new reality.

Free Wealth Health score

Free questionnaire to prioritise your goals and find out your current Wealth Health score. Self-improvements gotta start somewhere. That somewhere is here. Get Your Free Wealth Health ScoreMeet Your Wealth Coaches

As a Wealth Coach, I’ll help you identify what’s holding you back, build your confidence, and provide the knowledge and support you need to achieve your dream life. It’s not your fault you’re overwhelmed by finance—we’re not taught this in school, and many of us didn’t have financial role models.

I’m a qualified financial adviser and I’m here to use my 18 years of experience to guide you in building your financial knowledge and confidence so you can make better decisions and feel more in control of your money. Join me in becoming your best financial self—who knows where you could be in a year?

How it works

Wealth Health

Prioritise your goals and get your Wealth Health score Fill in the online questionnaire solo, or with a qualified Wealth Coach

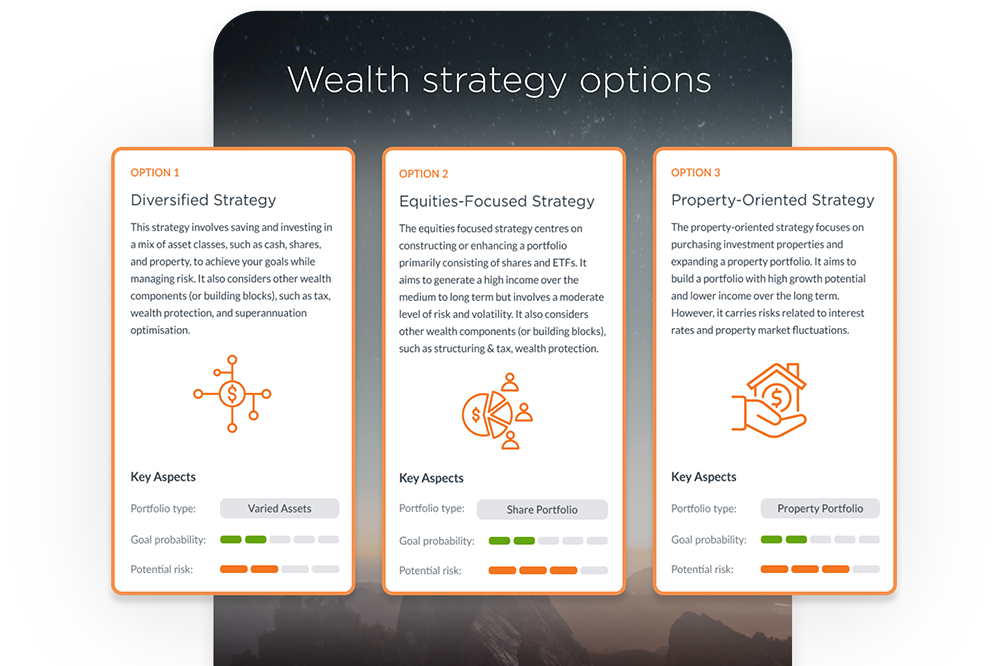

Your Strategy

You get 3 financial strategy options based off YOUR questionnaire This includes strategies relating to property, stocks, shares, savings and Super

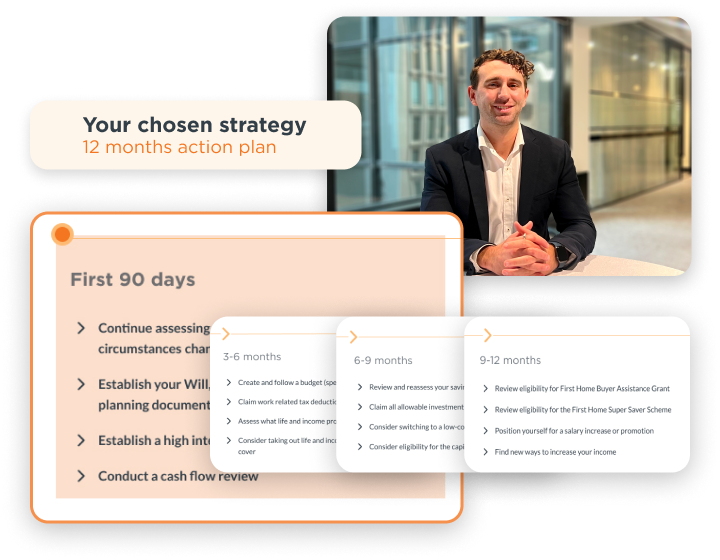

Action Plan

Decide which direction suits you (and Future You). Select your strategy to discuss your Action Plan with a Wealth Coach Deep dive into your 90-day plan, risks, considerations and possible impact on your financial future

Goal Smashing

Receive ongoing support to reach and achieve your goals Get personalised updates throughout your journey, including the next 90 day action plan, and access to group coaching too

Here’s what you get with Wealth Maximiser

One-on-one support from a qualified financial adviser

From $99 a month (an investment in yourself Future You would be proud of). Traditional Financial Advisors? Cost on average of $3,500 a year for one-on-one support. 😱 (Canstar, 2024)

A one-year Action Plan

Broken down into bite-sized, 90-day checklists to keep you on track and inspired to improve

Accountability

In a world of neverending distractions, it’s likely motivation will lapse if you’re the sole driver of your Wealth train. Enjoy ongoing access to an expert Wealth Coach, offering personalised advice tailored to where you’re at, and where you want to be (last call for Financial Freedom Station, baby!)

...and a little of what you don't get here

#sponsporedpost #ad

We don’t receive commissions from product providers. Advice tailored to you is objective and without any kickbacks, shares or royalties. Whichever way you slice it, nothing is influenced by commissions.

Get Started with a Goal Setting session with a Wealth Coach

Get access to a FREE 25-minute Goal Setting session with an experienced Wealth Coach. Because everyone should have someone in their corner, and you’ve got us. Book a Free Goal Setting SessionBook your no obligation

complimentary

25 minute Goal Setting session with a Wealth Coach

Book a free session