Engineers, take control of your financial future

Tailored financial planning made easy and affordable

Engineers Australia members get 20% off first annual financial plan & wealth coaching for a limited time*. Use code EngineersAus at checkout.

Why Wealth Maximiser

Wealth Maximiser is on a mission to make financial planning affordable, accessible and actionable for everyday Australians.

We combine cutting edge technology with expert coaches to help you achieve your goals and improve your financial wellbeing.

Wealth Maximiser covers the nine essential building blocks of wealth from income to investment to retirement and estate planning, and we don’t take product commissions – just the right advice for you.

How it works

Get Your Wealth Health Score

Fill out our online questionnaire to prioritise your goals and discover your Wealth Health score for free!

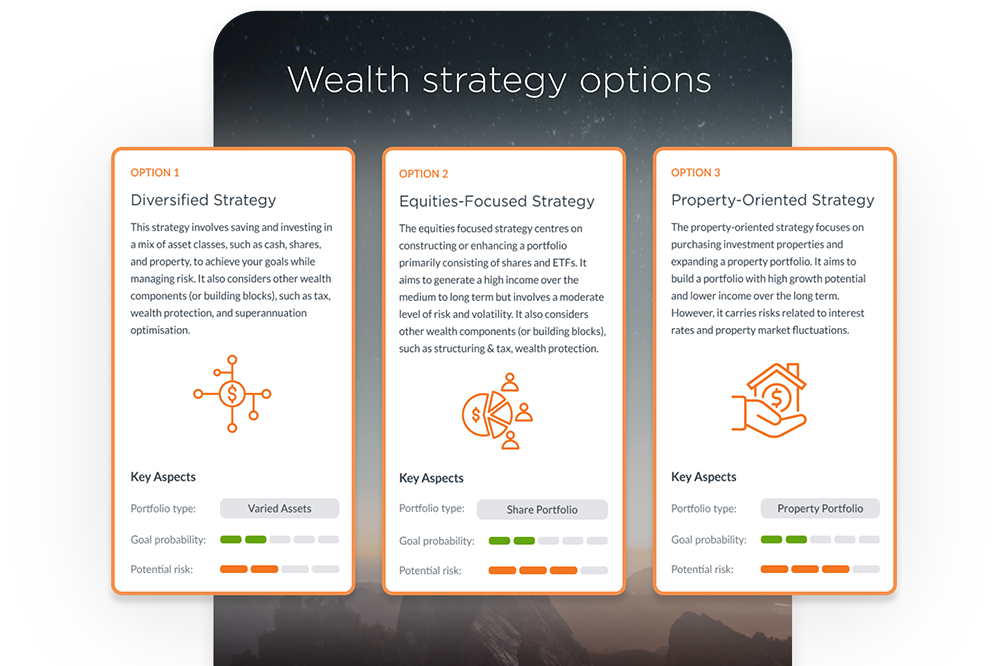

Choose from three recommended strategies

Choose your subscription and receive three customised financial strategy options—whether property, savings, or investments—designed for your unique circumstances.

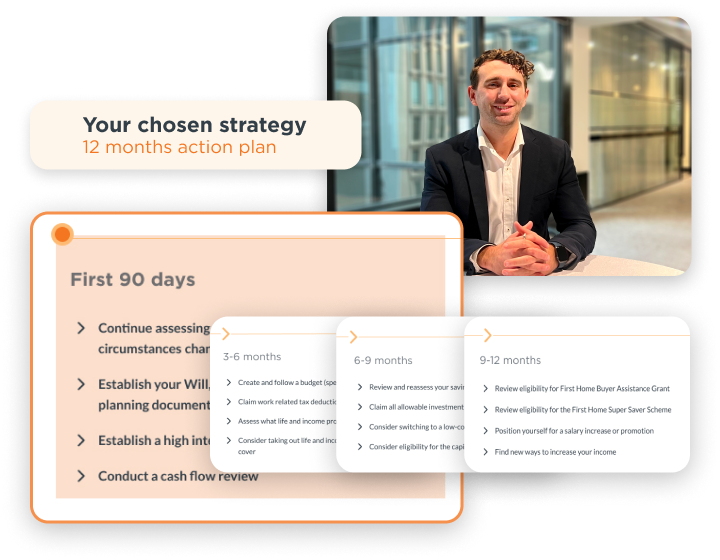

Personalise your Action Plan with a Wealth Coach

Discuss your strategy, understand the risks, and finalise a year-long plan designed for success.

Receive ongoing support to help achieve your goals

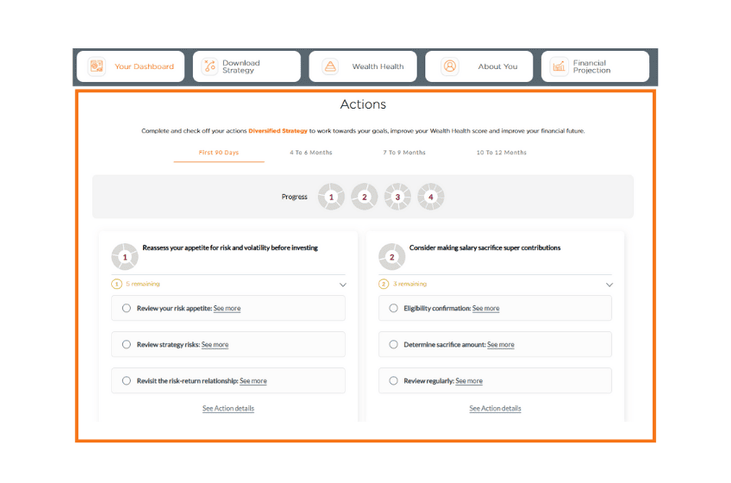

Access your dashboard for group coaching, regular updates, and actionable 90-day checklists to keep you on track and moving forward.

What you get with Wealth Maximiser

- One-on-one support from a qualified financial adviser from as little as $560 a year as an Engineers Australia member* or $99 a month

- Clear year long action plan broken down into manageable 90 day checklists

- 30 day money back guarantee. If you cancel your subscription within 30 days of purchase, we will refund you the full amount paid.

- We do not receive commissions from product providers.

What you often get with traditional financial advice

- One-on-one support from a qualified financial adviser costing an average of $3,500 a year. (Canstar, 2024)

- Complex and jargon-filled reports with an overwhelming amount of detail. (Choice, 2022)

- Advice that includes recommendations based on the commissions advisors receive (Choice, 2023)

Wealth Maximiser, a NobleOak initiative

For over 145 years, NobleOak has helped safeguard Australians. We put customers first and our life insurance business is award winning (see below). Wealth Maximiser is operated by NobleOak Services under its AFSL. As we provide objective advice and do not recommend products, we do not refer customers to our insurance products so Wealth Maximiser may not be suitable for individuals seeking comprehensive advice. Contact us to find out more.

What about the fine print?

We value transparency and doing the right thing by our customers.

We also know privacy and trust is extremely important when it comes to finances.

We are a trusted regulated financial business that will protect your data.

Please review our privacy policy, financial services guide and Wealth Maximiser

Terms and Conditions to learn more about Wealth Maximiser.

Questions before getting started?

Call us, book in a free call now or email us.

*Subject to eligibility. Please see the Offer Terms and Conditions here.

Please see our Disclaimer, here.

Book your no obligation

complimentary

25 minute Goal Setting session with a Wealth Coach

Book a free session